After programming bots and protocol stacks in an industrial environment for forty years, I’ve turned my abilities to developing indicators for NinjaTrader 8. NinjaTrader’s development system is top-notch, and I’m proud to be associated with them.

I have a lot of indicators still in development, but here’s what I’ve got so far:

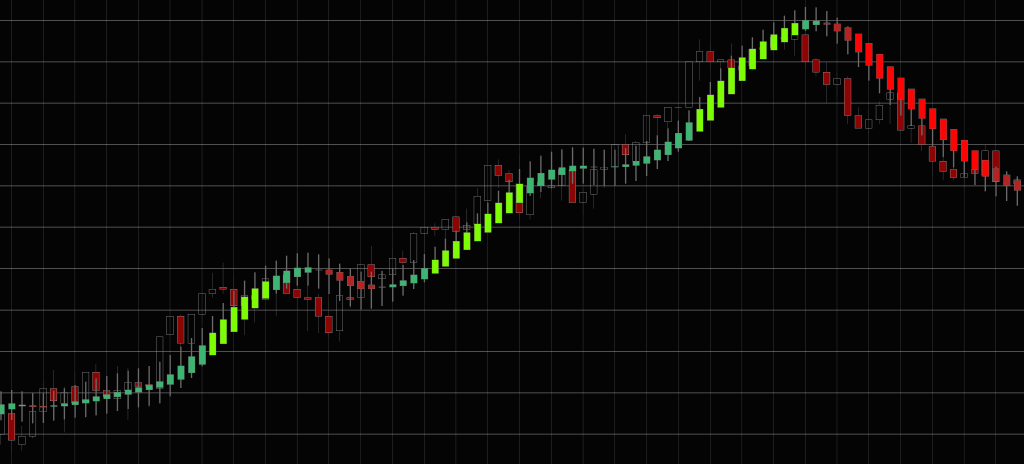

Earl’s Bodacious HAMA

Heiken Ashi Moving Average (HAMA) indicators for NinjaTrader 8 are, for some reason, few and far between. So I developed my own, and darn if it didn’t turn out to be really good. Features include:

- Ultra CONFIGURABLE

- DIVERGENCE identification made easy

- INDEPENDENT configuration for each price element (Open, High, Low, Close)

- Can be applied to RSI as well as to PRICE

It’s available for the low introductory price of $24, and you can get it HERE.

If you want to read the user manual, it’s available HERE.

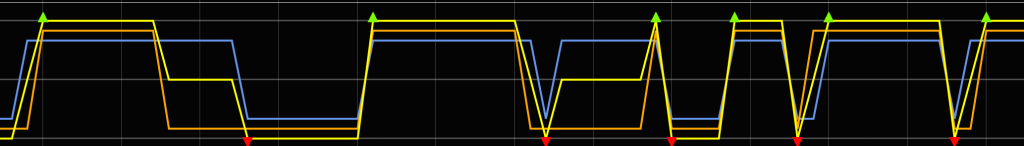

Earl’s Tremendous Trend Trigger

My Trend Trigger Indicator is not intended to be used in isolation. So please DO NOT download it and use it as a standalone Buy/Sell indicator.

Rather, it is intended to be used to help optimize the timing of trade entries indicated by other trading methods or indicators by showing when short-term price and longer-term momentum trends are in-sync.

It works pretty well with my Bodacious HAMA Indicator to time entries after a divergence is spotted.

Notable features include:

- Shows when Price Trend and Momentum Trend are in or out of sync.

- Provides hooks for use with an automated strategy, if that’s your thing.

For a more comprehensive description, click HERE.

This indicator is FREE, and you can get it HERE.

But please read the manual before use. You can get the user manual HERE.

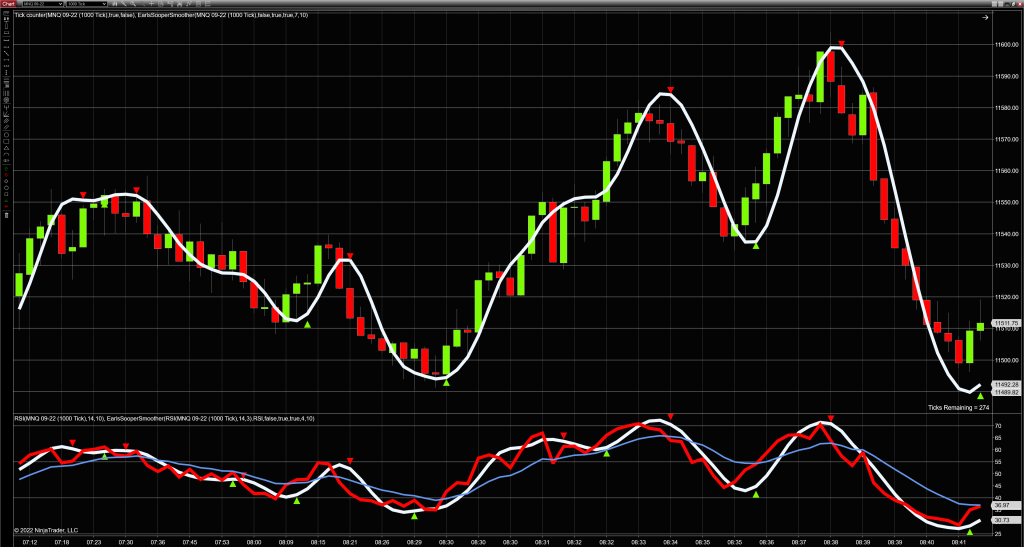

Earl’s Sooper Smoother

When data is difficult to analyze, we use indicators like moving averages to spot trends, reversals, and divergences. But most moving averages introduce a fair amount of lag, limiting their usefulness.

That’s where my SooperSmoother indicator comes in. It smooths out the data (and not just price data, but any data you want to feed into it, like RSI) while maintaining decent fit and minimizing lag.

Notable features include:

- Source data can be price, or any single component of any indicator.

- Two parameters (SSPeriod and SSFit) are used to tune the indicator for your data source and volatility.

- Triangles (used like arrows) can be optionally turned on to indicate SooperSmoother reversals. And hooks are in place so you can use these triangles in your home-grown strategies.

For a more comprehensive description, click HERE.

The indicator is FREE, and you can get it HERE.

But please read the manual before use. You can get the user manual HERE.